Course Name:

IND AS 12: Income Taxes (Advance Learning Series)

Delivered By:

CA CFE Harshad Tekwani

Hosted By:

The TaxEco – Knowledge Hub

Course Duration:

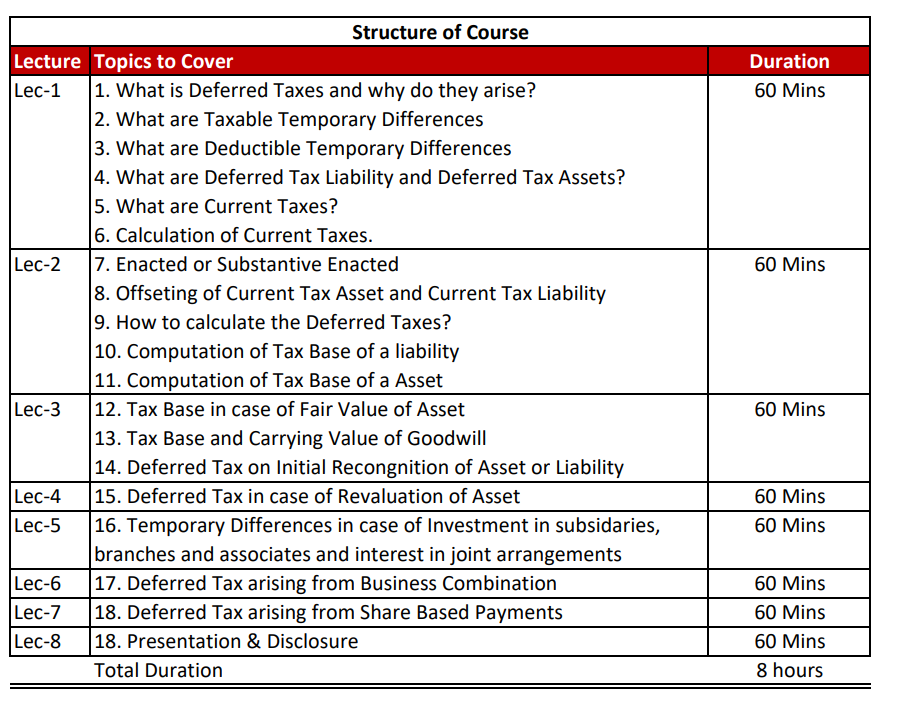

The course is divided in 8 Lectures of 1-2 hours each. The Course is in the format of Pre-recorded lectures. Candidates will be able to view this course through the Knowledge Hub Website only upon successful registration.

Pricing

For Indian Professionals / Students

Join Now! Before 31 March 2021 avail 20% discount on normal fees.

- For a total of 8 Lectures: 1,500 INR (as small as 187.5 INR per lecture) (1,875 INR) 20% Early Bird Discount.

International Students wishing to pay in INR can avail of the fee rate of Indian Students. Subject to conditions. To avail this offer kindly contact on below link:

For International Professionals / Students

Join Now! Before 31 March 2021 avail 20% discount on normal fees.

- For a total of 8 Lectures: 2,000 INR (as small as 200 INR per lecture) (2,500 INR) 20% Early Bird Discount.

International Students wishing to pay in INR can avail of the fee rate of Indian Students. Subject to conditions. To avail this offer kindly contact on below link:

- Overview of Course:

The Income-tax payable in India is payable under the Income Tax Act or DTAA on the Taxable Income. However, the Taxable Income and Profit disclosed in the Financial Statement are not necessarily the same. This can be on account:

- More / Less deduction allowed under the Income Tax Act or DTAA in compared to Books of Accounts,

- More / Less deduction allowed in Books of Accounts as per IND AS compared to the deduction allowed while calculating the Taxable Income as per Act.

So, what happens when the Taxable profit is different from the profit disclosed in the Financial Statement? Is paying & disclosing taxes as per the Income Tax Act under the books of account appropriate, even when the amount on which they are calculated is different.

The question of whether the liability of Taxes should be recorded based on the Profit disclosed in the Financial Statement or based on Taxable Income. Will it be appropriate to record the provision of Tax on Taxable Income when the Provision as per Profit disclosed in the Financial Statement is less? Will, it not be counted as over-provisioning?

To answer all these questions, the concept of deferred tax was Introduced. This course helps you understand:

- What Deferred Taxes are?

- When Deferred Taxes arise?

- How current and future income taxes are recognized and measured?

- How taxes are presented and which disclosures are required related to income taxes, according to Ind AS 12?

- How accounting of the current taxes are done?

The course includes practical examples and tests to enhance understanding.

- The Outcome of Course

At the end of the training the candidate will be able to perform the following:

- Understand the concept of deferred taxes and current taxes

- Identify situations when there is a need to account for deferred taxes and learn about recognition exemptions

- Define whether a deferred tax asset or a deferred tax liability arose

- Recognize the effect of under-or overestimation of current tax balances in previous years

- Define correct journals for current and deferred income taxes

- Review Ind AS 12 standard’s disclosure requirements